To address the lower results from online enrollment, carriers can partner with online enrollment providers to design experiences that are more personal, and connect on an emotional level

Key Takeaways:

- Online enrollment performs poorly based on three key metrics tied to ROI: Participation rates, employee satisfaction and employee advocacy. This gap is much worse for Accident and Critical Illness Insurance

- Face-to-face and telephone enrollment work better—mostly because they build emotional connections with employees. Online enrollment should follow this approach.

- Carriers and online enrollment providers must collaborate. To take this approach:

- Benchmark enrollment results by product, method of enrollment, and employee attributes

- Design, implement and measure improvements supported by benchmark data

It’s a good news/bad news story for online technologies used to enroll employees in their benefits.

The story – told by Customer Benefits Analytics (CBA) latest benefit enrollment study – found a significant performance gap between online and other enrollment methods. Studying what’s behind the differences is essential to those who want close that gap.

The good news is that our study found that more than two-thirds (67%) of employees enroll online, making it far and away the most common method of enrollment. The efficiencies gained by benefit administrators have propelled the growth of online enrollment, along benefits technology in general.

Yet, our findings show that online enrollment falls behind on several important measures related to employee experience when compared to other methods.

These findings – detailed in CBA’s multi-client study, “Personality of Benefit Buyers: 2018 Enrollment Research” – are surprising, and maybe difficult to accept for advocates of digital technology in employee benefits, including Customer Benefits Analytics.

The understand them to make improvements to help increase both employee signups and the value that employee satisfaction brings to employers.

Lower Participation Rates Reduce Premium and Commission

Employees who enroll online choose voluntary benefits less often. This disappointing result comes from our in-depth survey of 2,385 employees nationwide who had recently completed their benefits enrollment in November, 2017.

Respondents were asked by what method they enrolled most recently. We analyzed respondents’ by 4 categories defined as:

- Online (67% of respondents)

- Paper (10%)

- One-to-one, including in-person and by phone (14%)

- Combination of online, paper and one-to-one. (9%)

Index values were used to compare participation rates for each method relative to the rate for online enrollment.

| Chart A | Enrollment Method | |||

| All Products | Online | Paper | One-to-One | Combination |

| Participation Rate Index | 1.00 | 1.04 | 1.12 | 1.07 |

Chart A shows that overall participation rates, across 8 different benefit types, were higher in each of the other methods, from 4% higher (Index=1.04) when using paper, to a 12% advantage for (index=1.12) for one-to-one enrollment.

This performance gap between online versus other enrollment methods grows wider when analyzing Critical Illness and Accident insurance, both strategically important voluntary products, and, most recently, sources growth for brokers and carriers.

As shown in Chart B, setting the combined rate of enrollment for these products at 1.00 for easy comparison, the participation metrics for paper and one-to-one enrollments are 1.29, or 29% higher, and 28% higher for employees a combination of methods. (Note: the question on enrollment method was asked of the respondent overall, not specific to each product. Employees who enrolled online for medical and dental, but one-to-one for Accident, would choose, “A combination…”).

| Chart B | Enrollment Method | |||

| Accident and Critical Illness | Online | Paper | One-to-One | Combination |

| Participation Rate Index | 1.00 | 1.29 | 1.29 | 1.28 |

One-to-one enrollments often get high take-up rates. Yet finding that online under-performs paper enrollment is both surprising and problematic, given the considerable resources that carriers, brokers and employers have spent to shift paper enrollments to online. The survey findings indicates that online signups are missing the mark. As a result, carriers and brokers are missing out on nearly 30% more premium and commission by using online enrollment.

With so much at stake, it is a problem that needs to be addressed.

Lower Satisfaction and Advocacy Hurts Employers

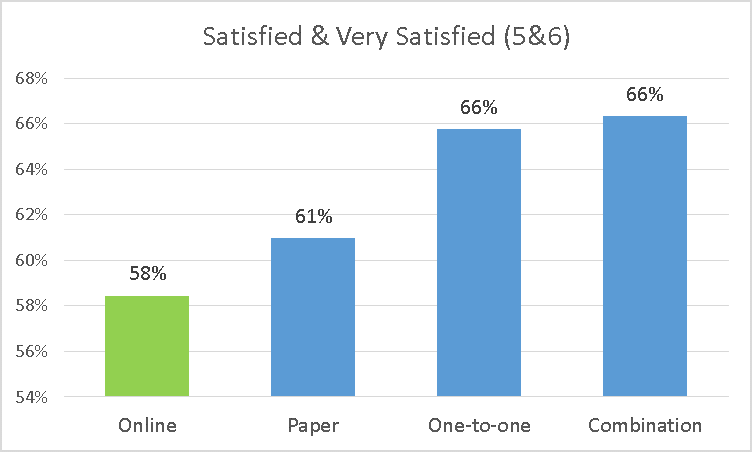

Lower levels of satisfaction and advocacy among employees who enroll online represents another disappointing finding from the research. Brokers tout employee benefits, and voluntary benefits in particular, as a way to attract and retain capable workers. To test the strength of this positioning, the research asked employees two related questions:

- How satisfied are you with the benefits offered by your employer?

- How likely are you to recommend your employer as a place to work to a friend or relative, based on your employers benefits program?

Both questions measure important effects of employee benefits, though “Likely to recommend” is critically important for companies who hire workers in today’s tight labor market. Overall, these metrics tell a positive story: 60% of employees are “satisfied” or “very satisfied,” and, with respect to the advocacy question, “Are you willing to recommend your employer…” about 50% are “likely” or “very likely” to recommend.

Again, however, there are surprising differences based on the employees’ method of enrollment.

Employees who enroll online are less satisfied with their benefits and less likely to recommend their employers compared to similar employees who enroll my other methods. For employees who enroll online, 58% are satisfied or very satisfied with their employers’ benefits programs. This number is marginally higher for employees who enroll by paper (61%), and noticeably higher (68%) for employees who enroll one-to-one or using a combination of methods. This finding holds across different size employers, regions, and industries.

Chart C: Satisfaction by Enrollment Method

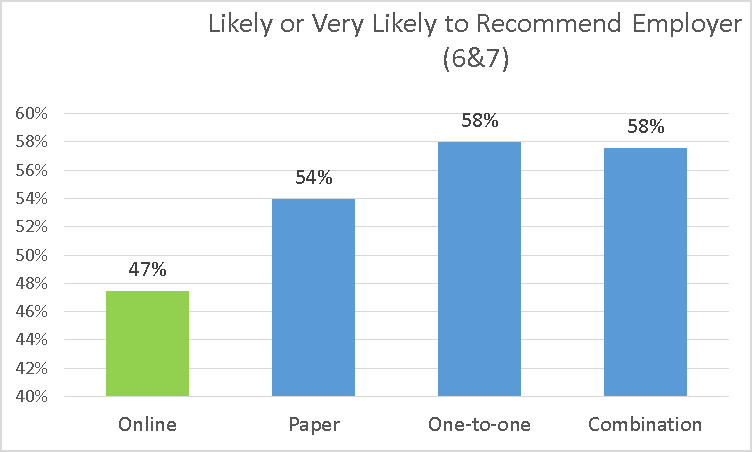

Most alarming for brokers and carriers should be online enrollment’s lower rate of employees who are likely to recommend their employers to friends and relatives, because it undercuts a key value proposition of employee benefits: attracting and retaining employees. Data shows that employees who enrollment online are 47% are likely or very like to recommend their employers, versus 58% for employees who use one-to-one enrollment, or a combination of methods, and 54% for employees who use paper enrollment.

Chart D: Likely to Recommend by Enrollment Method

Considering how valuable internal referrals are to firms who hire talent in a tight labor market, the degree to which employee benefits contribute to employees becoming advocates becomes a compelling reason to invest in good benefits. But communicating and enrolling those benefits in a manner that does not inspire such word-of-mouth advocacy wastes the opportunity. There is ample evidence in the research to build a cost-avoidance model based on hiring by internal referrals rather than external recruiters who charge 10-20% of first-year salary. Measuring how different components of the benefits program—products offered, funding levels, communication and enrollment methods, etc.—each contributes to the percent of employees who are likely to recommend the company, provides a tool to advise clients how to optimize their benefits.

Conclusion and Recommendation

The CBA survey finds that online enrollment is not working as well as other methods, despite the hundreds of millions of dollars which have been invested in digital enrollment, including avatars, videos, decisions support tools, calculators, and enrollment technology partnerships. Fundamentally, online enrollment experiences are not compelling because they do not make the necessary emotional connections with the employees. Still, two-thirds of enrollments happen online, so closing the performance gap with other methods carries a big financial reward.

This creates the perfect opportunity for online enrollment providers to collaborate with brokers and carriers to fix it. As a first step, enrollment partners can help brokers and carriers start measuring the extent of the gap in their own online channel, specifically in participation rates, satisfaction and advocacy. Benchmark these performance metrics against other methods of enrollment (e.g. one-to-one), as well as industry-wide online metrics to establish a performance baseline. Use an iterative, agile process to redesign online communications and engagements to insure that they make the right emotional connection with the customer. Use the benchmark metrics to evaluate, and implement each new component of the digital enrollment experience. Finally, deliberately steer new investment to where results are highest, especially holding accountable the ben-tech partners who do not deliver strong employee experiences. And continue to support other enrollment methods until the online experience is up to par.

Following these guidelines will lead to only good news for brokers, carriers, and online enrollment partners interested in improving the enrollment experience, and their bottom lines.

Patrick Toner is CEO of Customer Benefits Analytics, a data analytics firm that helps connect employees to the right benefits by using advanced analytics modeling of consumer-level data to provide rich customer insights and in-depth targeting. Prior to founding CBA, Patrick spent 12 years of in employee benefits marketing, enrollment strategy and e-commerce roles at Cigna and MetLife. More information on the benefits research, “The Personality of Benefits Buyers: 2018 Enrollment Research” can be found on here.