Choosing the right employee benefits package can feel overwhelming. Research shows we make decisions based off our gut emotions, and then use rational thoughts as justification. This holds true when making decisions about employee benefits.

by Patrick Toner

Key Takeaways:

– Benefits are purchased for a combination of emotion and rational reasons.

– Marketers need to connect to employees on an emotional level to secure the enrollment.

– The more you can personalize benefits for each employee, the better your enrollment success.

My previous post explained how data analytics improves the employee benefits experience by making it more personal. By collecting data about employees and thinking about them as consumers, we can build smarter profiles about them so we can optimize communications and engagement programs. Data for the buyer profile includes past benefits selections, demographic data, lifestyle data and psycho-graphic data that helps explain WHY employees make the benefits choices they make. Of course, clean, reliable, psychographic data is hard to find.

That’s why we partnered with Lodestar Advisory Partners to field our own study: Who Buys Voluntary and Why—2016 Benefits Enrollment Research. After we shared results with a few group carriers who sponsored the study, Employee Benefit News published some key findings of our research — also available here. The psychographic data is particularly revealing as a window into an employee’s enrollment mindset.

As part of the study, we asked 2,877 full-time employees of companies larger than 50 employees about the types of benefits they were offered by their employers, which benefits they selected, which they waived, and the primary reasons and secondary reasons behind their choices.

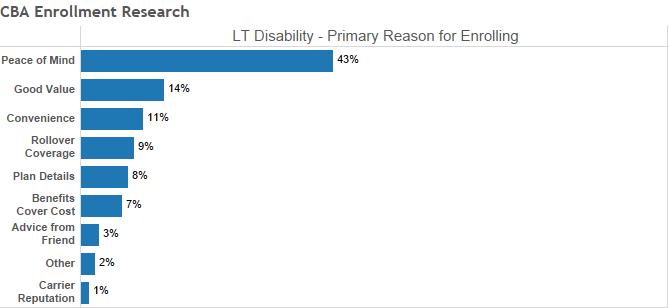

Our findings showed clearly that employees enroll for benefits based on emotional drivers, with the most important driver being “peace of mind. For example, nearly half (43%) of respondents to our survey indicated that peace of mind was their primary reason for selecting Long-Term Disability coverage.

This may not be a total surprise for those who sell insurance products, or many other products for that matter. Our research corroborates more extensive studies that consumers make purchase decisions based on “gut feeling”, and then support those decisions with more “rational” justifications.

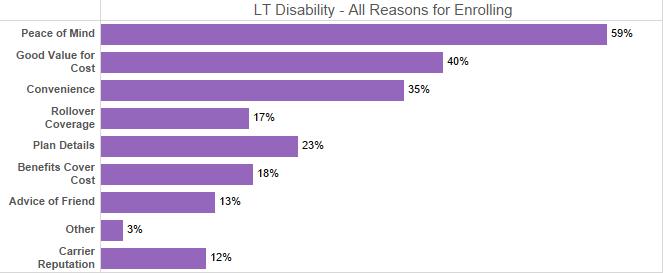

Insights from the research suggest ways to improve benefits communications. As mentioned earlier, nearly half (43%) of respondents to our survey cited “Peace of Mind” as the primary reason for selecting LTD coverage—more three times the percentage who cited “Good Value” (14%), the highest response on the rational scale. Rational responses were important factors, however, as can we seen in the list below of ALL reasons for enrolling (“Good Value for the Cost” – 39%, “Plan Details” – 25%), but were not the primary driver.

Our industry tends to rely too much on rational tools, rather than emotional triggers when communicating the value of financial protection products like LTD to employees. Rational approaches such as calculators, comparison grids, proof points and lists of features and benefits have their place, but only after we connect with employees on an emotional level about how LTD will make them feel, e.g. less anxious.

First, we have to make the emotional connection before using rational approaches to reinforce gut feelings about buying LTD. Vignettes and testimonials often work because they make the customer experience feel real, rather than theoretical. Through experiences, real or imagined, customers make emotional connections to employee benefits, and form their inclinations to enroll, or not.

Conclusion

Adapting your marketing communications to the emotional and rational needs of employees—as revealed through research—is not always easy. But, doing so will make your benefits feel more personal to each employee and will substantially improve your enrollment success. Next time we will describe our segmentation model and benefit buyer profiles based on this same research.